What is a chip card?

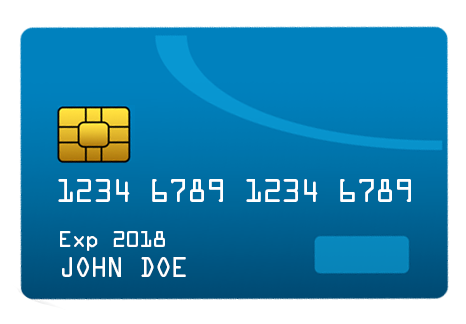

Using a chip card—also known as an EMV card—is a way of adding an extra layer of security when you pay. Chip cards can be used anywhere other cards are used, but the chip functionality only works at a business that has an activated chip-enabled terminal.

Why are chip cards more secure?

The chip “encrypts” your personal and purchase information into a unique code that makes card replication and fraud more difficult when used at a chip-enabled terminal.

How is a chip card used?

- Chip cards are inserted into the chip-enabled terminal with the chip first, facing up. The card is left in the terminal until the transaction is complete. You may be prompted to sign your name.

- Chip cards will continue to have a magnetic stripe on the back for use in places where chip technology is not yet available. If there isn’t a chip-enabled terminal, use the card the traditional way and swipe.

- For phone or online transactions, nothing changes. Simply provide your card number and complete your transaction as you do today.

Can I still use my card if it does not have a chip?

YES! It will take time for all retail terminals and cards to be updated with chip technology. Therefore, magnetic-stripe cards will still be accepted.