Although no one can predict with 100% accuracy how much longer this hard insurance market may last, there are economic trends that can provide insight. First, we’ll look at several economic indicators and then we’ll share ways to prepare so you’ll be well-positioned to meet emerging customer needs when the insurance market softens.

Economic Trends to Watch

There are numerous tools and trends that can be used to assess the current marketplace — these trends can affect your day-to-day activities and mid-term planning. It’s also important to remember that there are variations among different regions, states, cities, and even certain industries. As you review the most recent data shown below, keep in mind that trends can change as the year progresses, delivering the potential for a softer insurance market.

While unemployment, inflation, and consumer confidence can have an effect on general buying behaviors (including insurance), natural disasters, insurance industry trends, and premium costs directly impact policyholder decisions related to which agencies they’ll work with and which policies they’ll buy or let lapse.

- Insurance Industry Results and Projections: According to a report from the Insurance Information Institute (Triple-I) and Milliman, the U.S. property and casualty insurance industry reported a net combined ratio of 96.6 in 2024, representing a 5.1-point improvement from 2023 — and the best results the industry has seen since 2013.

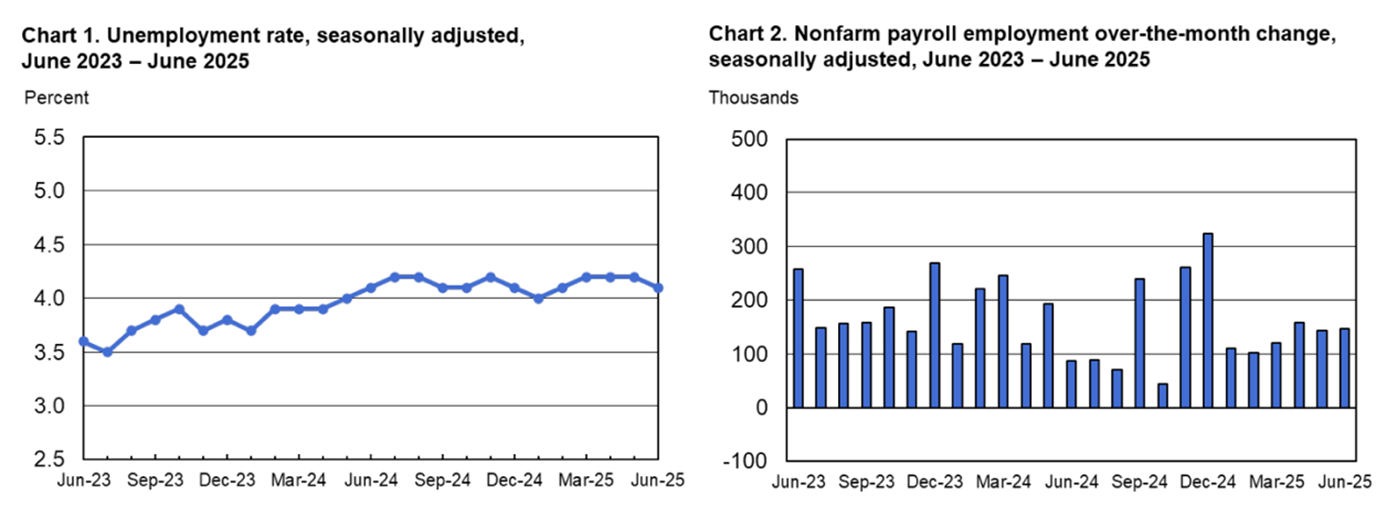

“(However,) while P/C economic drivers continue to outperform the broader U.S. economy … we now anticipate a shift in 2025 due to ongoing and expanded tariffs,” said Michael Léonard, Chief Economist and Data Scientist at Triple-I. - Employment Data: The unemployment rate held fairly steady at 4.1% and non-farm payroll employment grew by 147,000 in June of 2025, which is comparable to the previous 12-month average gains of 146,000, according to the U.S. Department of Labor’s (USDOL’s) Bureau of Labor Statistics (BLS). The charts below were pulled from a July 3, 2025 news release from the BLS:

- Consumer Confidence and Spending: “Consumer confidence weakened in June, erasing almost half of May’s sharp gains,” said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board. In addition to the Confidence Index® dropping by 5.4 points in June 2025, the Present Situation Index (based on consumers’ assessment of current business and labor market conditions) fell 6.4 points, and the Expectations Index (based on consumers’ short-term outlook for income, business, and labor market conditions) fell 4.6 points.

- Inflation: The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1% on a seasonally adjusted basis in May of 2025, after rising 0.2% in April, the U.S. Bureau of Labor Statistics reported in mid-June. Over the last 12 months, the all-items index increased 2.4% before seasonal adjustment, while the food index increased 2.9% over the last year.

- Real Estate Patterns: The housing market is an essential metric to review, from multiple perspectives. The National Association of Home Builders pulled data from The Conference Board, noting that people planning to buy a home fell slightly to 5.9% in June. Buyers of both new construction and existing homes dropped.

The May 2025 REALTORS® Confidence Index Survey showed that 18% of respondents expect a year-over-year increase in buyer traffic in next 3 months, which represents a reduction of 3%. But there is good news, too — homes were selling at a more rapid pace, spending just 27 days on the market, rather than the previous 30. - Interest Rate Movement: Economists at Goldman Sachs had been expecting that the Fed would reduce its Fed Funds Rate twice before the end of 2025, but now they’ve adjusted their outlook to anticipate three rate cuts yet this year, although last week the Fed didn’t move.

According to TheStreet, Goldman Sachs altered their projection based on lower-than-expected impacts from tariffs on inflation so far, as well as continued questions about the jobs market. You can learn more by reading “Navigating Economic Shifts and Potential Rate Cuts” which we recently published on the First Mid website. - Natural Disasters and Claims Data: “The hard market has clouded the insurance industry’s outlook, but opportunities are coming into focus as well,” PropertyCasualty360® reports. The January 2025 article shares that there has been growth in the surplus lines space for brokers exposed to different markets.

Yet, the California wildfires could reduce or wipe out gains made in the P/C space. There are also concerns about a hurricane season with higher-than-normal activity, as predicted by NOAA (National Oceanic and Atmospheric Administration). As of this writing, the 2025 hurricane season is in its early stages, but it continues to be on the radar until November 30th, the official end of the season.

Preparing Now for a Strong Future

You can lay the groundwork now so that you will be ready to act when the market softens. Being proactive may drive you ahead of your competition who are reacting after the market softens allowing you to increase the number of customers and the lifetime value of clients already in your book.

- Deliver Superior Customer Service: The high insurance shopping trends come even as premium increases slow, according to J.D. Power’s “2025 U.S. Insurance Shopping Study.” Take good care of your customers, and they may be less likely to shop around. If they do seek out lower prices, educate them on coverages and options so they discover your customer service and personal attention outweigh saving a few dollars.

- Invest in Targeted Prospecting: In addition to any mass marketing you may do, consider focusing on converting auto policies to your agency. J.D. Power’s “2025 U.S. Auto Insurance Study” revealed that 38% of personal auto insurance customers in the United States are dissatisfied with their insurance. Define what makes your policies more appealing, identify carriers that are known to disappoint their insureds, and double-down on your commitment to five-star service.

- Foster an Agile Culture: Encourage your team to recognize the value in being able to adeptly pivot and flex to meet customer needs or take advantage of favorable economic changes. Of course, this flexibility needs to be combined with enough self-discipline and structure to be strategic about making pivots. Agile doesn’t mean be careless; make the pivots quick and well-coordinated.

- Invest in Yourself — and Your Agency: Being able to deliver on the first three items on this list may require additional working capital. Whether that takes the form of staff training, hiring additional team members, committing to a marketing plan, updating hardware and software, these things don’t happen overnight. It’s a four-step process:

- Identify the need or opportunity, including a preliminary action plan.

- Create a budget for one or more of these initiatives.

- Identify the source of funding, either through cash on hand or considering a working capital loan.

- Execute your plan and modify as needed.

As respected leadership authority, Steven Covey, said, “I am not a product of my circumstances. I am a product of my decisions.” This is especially applicable in today’s world where we’ve lived through a global pandemic, political dissention, and a fluctuating economy — all of which are circumstances beyond our individual control.

First Mid specialized insurance financing expertise enables us to provide guidance and financing that makes sense for your unique needs. Insurance agents like to conduct annual checkups with their customers, and we like to do the same for our insurance agency clients. Please email us at agencyfinance@firstmid.com, call 877-894-2785 or fill out this online form to learn more.

View more Helpful Resource Articles or go to our Home Page