Owning and efficiently running an insurance agency has evolved significantly over the last 10 years, with staffing becoming one of the most impactful changes. Competition for qualified sales, customer service staff and administrative employees continues to rise — however, you now have more options for building a solid team that represents your agency well. In this article we’ll look at three staffing approaches so you can make the best choices for your agency’s needs.

In-Person Staff

One of the most important employees in an insurance agency is the person who interacts face-to-face with customers. Not only does this staff member need to be extremely competent and knowledgeable, they must also have impeccable relationship skills. In-person employees are also essential to handle tasks that require confidentiality and discretion.

Employees that work onsite require a workstation and equipment, which can affect the square footage needed, eventually increasing your overhead expenses. In today’s competitive job market, employees that are asked to work onsite may have higher expectations for salary and benefits.

Yet, the impact of a top-notch in-person employee can provide extreme value in terms of efficiency, customer acquisition and retention, and your confidence in their abilities.

Remote Employees

Filling some of your open positions with remote staff can be a cost-effective option, while also providing you with some of the benefits of onsite employees. Rather than choosing to engage freelance or contract talent, giving remote workers the advantages of employee status can increase their loyalty to your team.

Remote staff can miss out on the camaraderie of working side-by-side their peers and being mentored by senior employees. However, there are many highly qualified people who don’t miss the daily interactions — or even strongly prefer to meet their job requirements in a non-traditional environment. Ignoring the option of remote employees can limit your access to skilled professionals who could bring great value to your team.

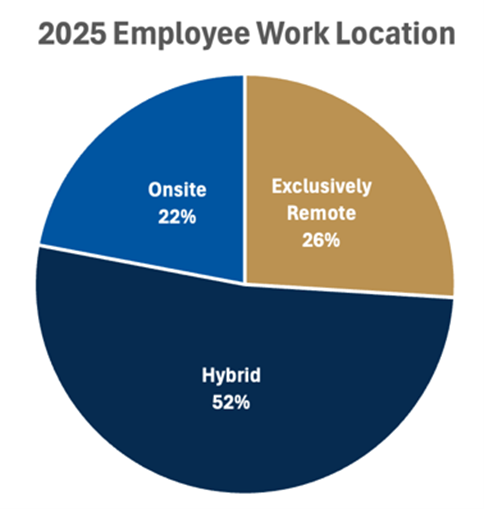

Recent research from the well-respected staffing agency, Robert Half, revealed that just 19% of job seekers said their top choice is an in-office job, while half prefer hybrid work and a quarter opt for fully remote. Job location also affects employee retention with 76% of workers indicating that having flexibility in when and where they work influences their desire to stay with an employer.

Financial pros and cons of utilizing remote staff varies by location, skill level, and other factors. You may be able to save on wages and taxes if your agency is in an area where high wages prevail, but you hire a remote employee from a state where their cost-of-living is lower — of course the inverse of this is also true. Other financial factors include benefits, which would be offered to remote employees, while contracted workers (outsourced staff) don’t typically participate in health insurance, retirement plans, PTO offerings, and other perks.

Outsourced Workers

Also known as contractors, outsourced workers can be used in a couple of ways for an insurance agency. One way is through hiring from employment agencies which allow you to test out the skills and productivity of the worker and reduce the overall payroll costs versus full time employees and the employment agency can interview and find viable candidates which reduces your time evaluating new hires.

The second way is to have your in-house or remote staff be 1099 contractors versus employees. This can reduce payroll tax and benefit costs as you ensure the worker can hit your goals for them.

Ways to find the perfect staffing mix

Although it would be nice to have an exact formula to staffing success, each modern agency has its own unique characteristics that affect the “right” mix of staffing approaches.

Track and evaluate your staff’s goals and productivity. Monitor it over time to determine if there are characteristics that are shared by the most productive staff members. Consider including characteristic like prior insurance, customer service or sales experience, years in the community, number of active referral relationships, type of employment (remote, in house, outsourced) and any other characteristics that are important to you. Then monitor their goals and activity each month. This may provide helpful insight into the characteristics that produce the best employees for your agency.

Talk to your colleagues and fellow agency owners to learn what’s working for them. You may also be able to glean insights from small business owners in your community.

Consider contacting a consultant that specializes in staffing and office dynamics if you’re still unsure about the best staffing mix for your agency’s growth. You may have access to similar resources within industry associations or the corporate offices of the carriers you work with.

We hope this information helps you determine if you’re already in the right place with your team or if tweaking your approach could improve your agency’s efficiency, culture and results.

As always, we are here to support your business goals and financial needs. Please reach out to our team of specialized agency finance experts or call 877-894-2785.

View more Helpful Resource Articles or go to our Home Page