Has your insurance agency hit a plateau? Maybe it’s time to consider making an investment in marketing to help boost your agency’s growth.

While some people refer to marketing as an expense – which it technically is – putting dollars into strategic, targeted marketing is an investment that can pay dividends in the form of new clients, increased lifetime value from current clients and a more resilient book of business.

Where Do I Start?

In today’s world, there are endless marketing opportunities – Facebook ads, YouTube videos, email campaigns, billboards, direct mail, content marketing, search engine optimization – and it seems like more options pop up all the time.

To avoid making costly marketing mistakes, it’s important to begin with a solid strategy and to make a commitment to ongoing efforts, according to the experts at Central States Marketing (CSM):

“The strategies we develop are backed up by our ability to identify, define and execute the various marketing tactics that will get the job done. Continuous assessment and strategy tweaks ensure that we provide you with optimum Return On Investment (ROI).”

Calculating Marketing ROI

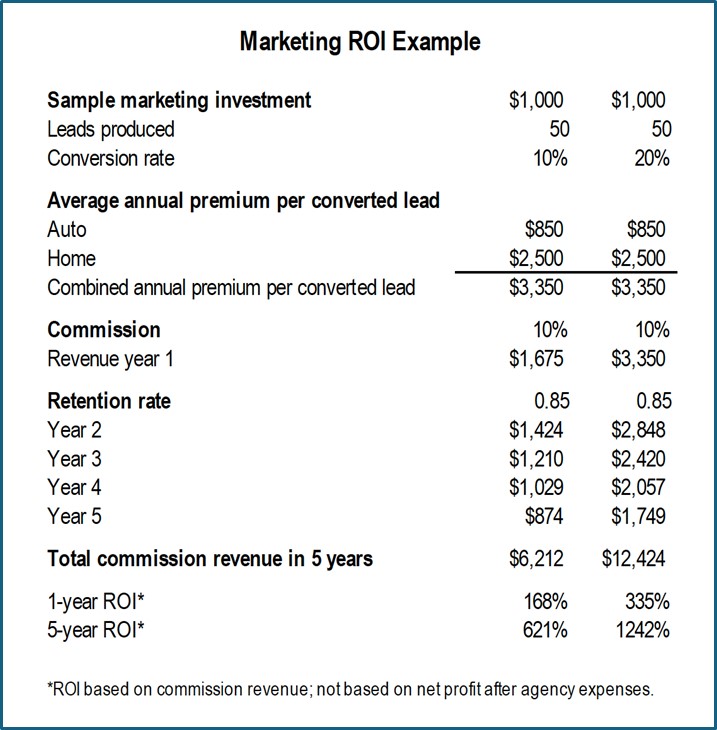

Measuring ROI should be the primary factor as you consider making an investment into marketing. We’ve broken down the potential numbers based on a hypothetical marketing budget of $1,000. Of course, nearly all marketing initiatives will cost more than that, but we’ve chosen that number for the sake of simplicity.

It’s also important to note that the number of leads (50), conversion rates (10% and 20%) and premiums generated by this hypothetical $1k spend aren’t based upon an actual marketing plan and will differ from region to region. However, this does demonstrate the importance of looking at ROI over the long term by taking into account key factors including:

- Differing product premiums

- Varying commissions by product

- Varying commissions by product

- Renewal rates for subsequent years

- Cumulative ROI over a five-year timeframe

Invest in Your Future

If you don’t have enough room in your budget for marketing and advertising – or you don’t want to dip into your cash reserves – a working capital loan can provide the funds to kick-start your marketing activities. The First Mid specialized agency lending team is committed to helping insurance agencies thrive and grow, including helping you determine how much your agency can borrow for capital needs or other expenses.

We’ll walk you through our efficient agency loan process and be responsive to your needs. Because some agency owners prefer human-to-human contact and others prefer a more digital banking experience, we expertly bring both approaches together to ensure a positive lending experience – and a rewarding, long-term relationship.

We make it easy to get started or enhance your existing banking relationship with First Mid. Email us at agencyfinance@firstmid.com, call 877-894-2785 or fill out this online form.

View more Helpful Resource Articles or go to our Home Page