Whether you’re looking forward to completely retiring or you want to maintain a connection to your agency, there are many factors to consider as you begin to develop a succession plan and exit strategy. Today we’re taking a look at succession objectives, agency valuation trends, lending resources for buyers and achieving a balanced outcome.

Defining Your Exit Objectives

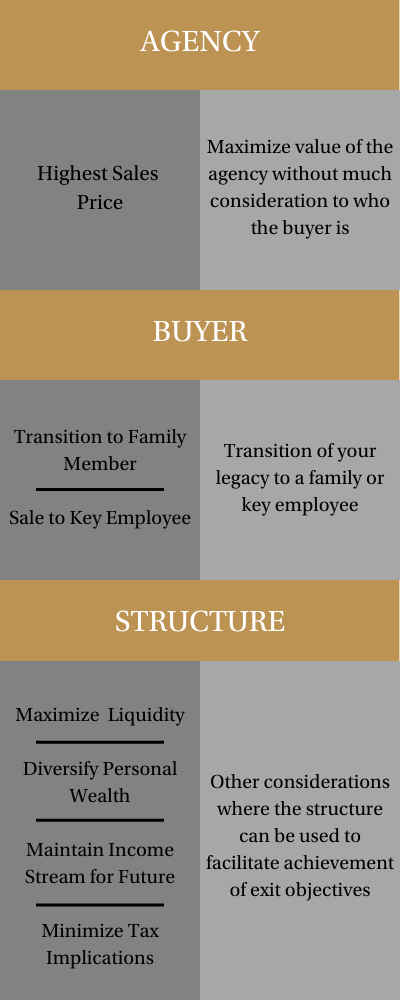

As you begin your succession planning, it’s critical that you decide what your exit priorities are. While some may be focused primarily on selling the agency for the highest price as they exit the business completely, others look at the succession plan as a way to carry out the agency’s legacy with a transition to a family member or key employee.

You can learn more about the mindset and approach to your succession plan in our previous post titled Perpetuation.

In addition to the agency’s market value and choosing the best buyer, there are four objectives within the exit structure that need to be prioritized to meet your individual tax, income and liquidity goals.

All four structure options shown in the table on the right can be accomplished by leveraging your agency with debt, which is something that absentee owners have been doing for years. However, if you’re looking to maximize personal liquidity at the time of exit, this will require the buyer to have the most cash (or lending capacity) upfront.

Trends in Agency Valuation

One of the trickiest issues with any succession plan — in any industry — is determining the valuation. Here are three trends that are having an impact on insurance agency valuations.

Macro Level Factors

Two macro level factors impacting valuations are the size of the agency and geography. Larger books are more likely to sell at a premium historically. However, there has been some reduction in value on larger agencies, especially if they did not benefit from a merger transaction of a smaller agency. Geographic area can have an impact on valuation especially when it comes to product competitiveness. For example, certain carriers announced agent compensation changes in certain states to inhibit market growth due to unprofitable segments. For a captive agent in those geographic areas, those changes can impact valuation. Additionally, growth in certain geographic locations where there may not be termination value assigned to that growth can also impact valuation.

Valuation as Multiple of Revenue is Being Replaced as Key Benchmark

Historical changes to compensation structure have created more variability and complexity in the revenue stream. Given that variability, we’ve seen multiple of revenue or annual commission being replaced with a multiple of written premium and is now migrating to a multiple of Earnings Before Income Taxes Depreciation and Amortization (“EBITDA”).

Buyer Access to Capital is Becoming More Limited

While historically low interest rates previously increased borrowing capacity, the last year of rising rates along with inflation is putting pressure on cash flow which can reduce the amount that can be financed. Lenders in this space have come and gone, reducing the number of financing sources. Termination payments and contract values are not the safety net they previously were. For captives, approval of mergers rests with the carrier and restrictions are placed on buyers. These factors result in more seller debt being necessary as lenders gravitate towards lower advance rates.

When combined, these individual trends are resulting in lower sale values that are harder to finance, ultimately resulting in more use of seller debt.

The “Right Time” is Closer Than You Think

Insurance is designed to prepare your clients for both expected situations and unanticipated bumps in the road. Agency succession planning does the same for your financial future — and there’s no time like the present to start thinking about your exit objectives.

How Lenders Evaluate Loan Requests

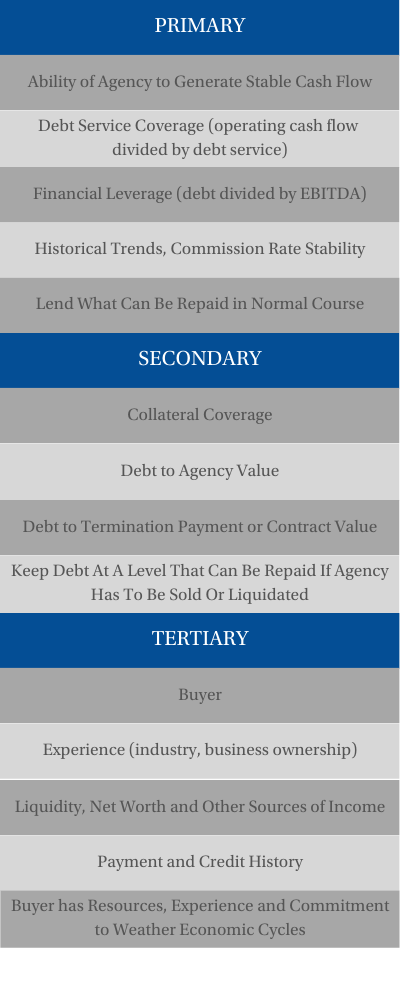

Once the agency valuation and structure are agreed upon, the next step is financing. A lender typically evaluates a buyer’s loan request in three main categories.

Achieving “Balance” to Maximize Value

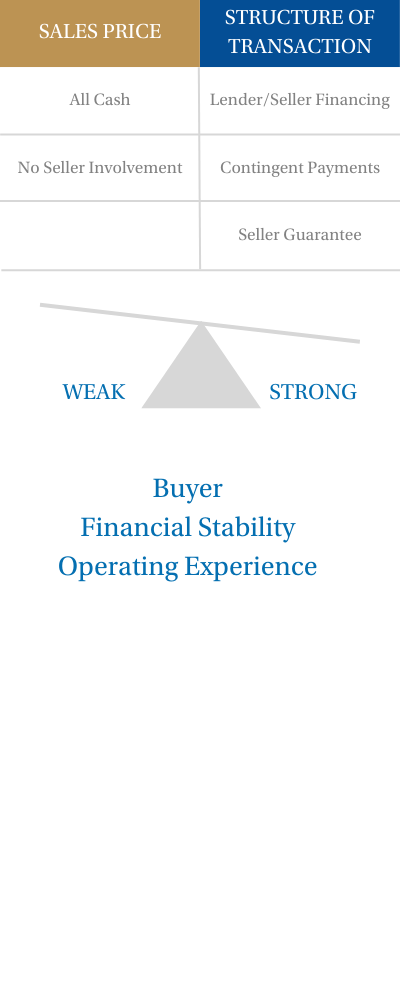

The strength of your buyer, their financial stability and historical experience will all play into your ability to maximize value in a structure that will accommodate both buyer and seller objectives. The stronger the buyer, the less structuring you will have to do to mitigate their perceived weaknesses from the lender.

What do you do to Achieve “Balance” and Maximum Value

View more Helpful Resource Articles or go to our Home Page