Below are important details about Personal Online and Mobile Banking services for our new Blackhawk Bank customers, including first time log-in instructions.

Personal/Retail Online Banking

PLAN AHEAD: You may continue to access your Online Banking through Blackhawk Bank until 4:00 p.m. (CT) on Friday, December 1, 2023. Scheduled transactions made prior to 4:00 p.m. will be processed as normal. After 4:00 p.m. (CT), Online and Telephone Banking will be in inquiry only and you will no longer be able to transact on your Blackhawk Bank account. Mobile Banking and Mobile Deposits will no longer be available after 4:00 p.m. (CT).

If you use Bill Pay through Blackhawk Bank, access to the Bill Pay system will end at 4:00 p.m. (CT) on Thursday, November 30. We strongly recommend printing your Blackhawk Bank Bill Pay history, payees, and recurring payment information prior to Thursday, November 30, in order for you to validate information converted from the existing system.

Print or archive Blackhawk Bank eStatements, check copies, etc. This must be completed before 4:00 p.m. (CT) on Friday, December 1, 2023.

If you use Quicken® or QuickBooks® software, you’ll find available guides here to assist you in transitioning to your new Online Banking platform.

Your First Time Logging In

Beginning Monday, December 4, 2023, you may log into your account using First Mid Online Banking.

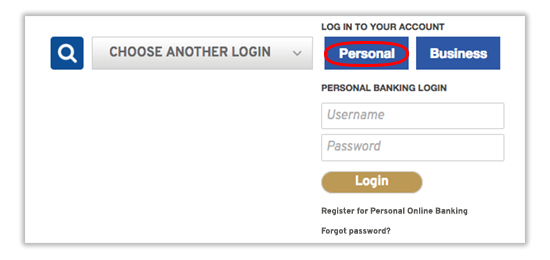

At the top of our website, click the blue “Personal” button to access the Online Banking login area for personal accounts.

- Your username will be your current Blackhawk Bank User ID.

- Your temporary password will be “B” followed by the last six digits of your social security number and “Hawk$”. (Example: B123456Hawk$ )

- Once you are logged in, you will be prompted to change your temporary password.

Please note: Any personal/retail account that holds more than 3 owners could experience a delay over the conversion weekend. If you do not see all the accounts that you are used to seeing, please contact Customer Support at 877-888-5629.

Learn more about the features of First Mid’s Personal Online Banking.

Mobile Banking

If you are currently enrolled in Mobile Banking with Blackhawk Bank, you will need to re-enroll with First Mid beginning December 4, 2023.

Download the First Mid Mobile Banking App. First Mid Online and Mobile Banking platforms are directly connected. You may also enroll in First Mid’s Online Banking directly from the Mobile App.

Mobile Deposit

First Mid does offer a Mobile Deposit solution through the mobile banking app for personal accounts. Mobile deposits made before 4:00 p.m. (CT) will be processed within the same day. Any Mobile Deposit submitted after 4:00 p.m. (CT) will be processed the next business day. Mobile deposit funds are generally posted to accounts next day but could take up to two business days.

Mobile Bill Pay

First Mid’s Bill Pay platform can be accessed through the Mobile Banking app. To utilize Mobile Bill Pay, you will first need to enroll through a web browser. If you are currently enrolled for Bill Pay with Blackhawk Bank, you will not have to re-enroll for First Mid’s Bill Pay Service.

Learn more about the features of First Mid Mobile Banking.

Telephone Banking

First Mid offers a Telephone Banking Solution.

ACTION > If you currently use Telephone Banking with Blackhawk Bank, you will have to re-establish your profile with First Mid. As of December 4, 2023, you may call 800-500-6085 and follow the prompts. The first time you use telephone banking, your PIN will be the last 4 digits of your social security number.

Online Banking Money Movement

First Mid offers solutions to transfer money to another Financial Institution, send money to a friend, and pay bills all in one place. These requests can be completed through Online Banking Transfers, TransferNow, Zelle®, or Bill Pay. The solution to be used will depend on the purpose of the transfer. If you have questions or would like clarification on these options, please reach out to Customer Support at 877-888-5629.

Account Transfers

ACTION > Any scheduled or recurring transfers currently set up through Online Banking with Blackhawk Bank will continue without interruption.

PLAN AHEAD: Transfers will not be completed over conversion weekend, after 4:00 p.m. on December 1 through December 3, 2023.

ACTION > Any external transfer currently established will need to be re-established in First Mid’s Online Banking. Within Bill Pay, you may use TransferNow to send funds between your First Mid account and your account at another Financial Institution. We also offer Zelle® through Bill Pay. As of December 4, 2023, you will need to re-enroll in the Zelle® service and re-register your social token. See additional instructions for current Zelle® users here.

If you do not currently have the ability to request external transfers and would be interested in having the ability, please request enrollment through your banking center or contact our Customer Support Center at 877-888-5629.

Bill Pay

ACTION > If you are currently utilizing the Blackhawk Bank Bill Pay system, access to the system will end at 4:00 p.m. (CT) on Thursday, November 30, 2023. You will need to re-establish any eBills on the First Mid system. Scheduled and recurring payments will be automatically converted to the First Mid system. We highly recommend that you print your Blackhawk Bank Bill Pay history, payees, and recurring payment information prior to November 30, 2023 in order to validate information converted from the Blackhawk Bank system to the First Mid system.

PLAN AHEAD: Please take into consideration that your first payments within Bill Pay will be processed as a paper check, regardless of what payment method you select. The First Mid system must verify all new accounts and subscribers. If you need further information, please contact Customer Support at 877-888-5629.

If you are not currently enrolled for Bill Pay and would be interested in having the service, you can enroll for Bill Pay through the First Mid Online Banking platform starting December 4, 2023.

Notifications and Alerts

First Mid offers a variety of account alerts that may be set up within the Online Banking platform. These can be sent via email, push alert, or text message (SMS). If you currently receive alerts for your Blackhawk Bank deposit accounts, you will need to log in to First Mid’s Online Banking and establish any alerts you wish to receive.

Account Management Software

First Mid allows customers to connect their accounts and Online Banking to various account management software.

ACTION > If you are currently using QuickBooks® or a similar solution, you will need to download your transaction history from the Blackhawk Bank Online Banking system prior to December 1, 2023. After that date, you will only be able to download your First Mid transactions. Transactions that will post to your Blackhawk Bank account Friday night, December 1, 2023, will need to be manually entered into your account management software.

The current Budgeting Tools that Blackhawk Bank offers today will not be available after Friday, December 1, 2023. However, with First Mid’s Personal/Retail Online Banking, you will have the ability to categorize your transactions. If you wish to save your accumulated information from your Blackhawk Bank financial management tool, you should save or download that information prior to 4:00 p.m. (CT) on December 1, 2023.

Wire Processing

Outgoing Wire Transfers

Retail customers can initiate outgoing wire transfers with any of our banking center locations. Outgoing wire transfers can be requested Monday through Friday during Bank hours. Requests submitted and approved before 4:00 p.m. (CT) will be processed same day. Any requests completed after 4:00 p.m. (CT) will be processed the next business day. However, there is no guarantee that the wire will be posted by the Receiving Bank same day. First Mid outgoing wire instructions can be provided upon request. No wire transfers are processed on Saturday, Sunday, or bank holidays.

Incoming Wire Transfers

Incoming wire transfers are accepted and processed by First Mid, Monday through Friday, until 4:00 p.m. (CT). Any incoming funds received after 4:00 p.m. (CT) will be posted on the next business day. First Mid does hold a Swift code for International Incoming wires which allows for faster processing times. No wire transfers are processed on Saturday, Sunday, or bank holidays.

Incoming Wire Instructions:

First Mid Bank & Trust

1515 Charleston Ave.

Mattoon IL 61938

ABA | Routing number: 071102076

Swift | BIC Code: FMAUS44

Wire Fees:

Domestic Outgoing Wire Fee – $20/wire

International Outgoing Wire Fee – $75/wire

Foreign Exchange Outgoing Wire Fee – $75/wire + exchange rate

Incoming Wire Fee: $10/wire

If you have any questions regarding the conversion and your Online or Mobile Banking services, please contact our Customer Support at 877-888-5629.